What is the difference between CEX and DEX?

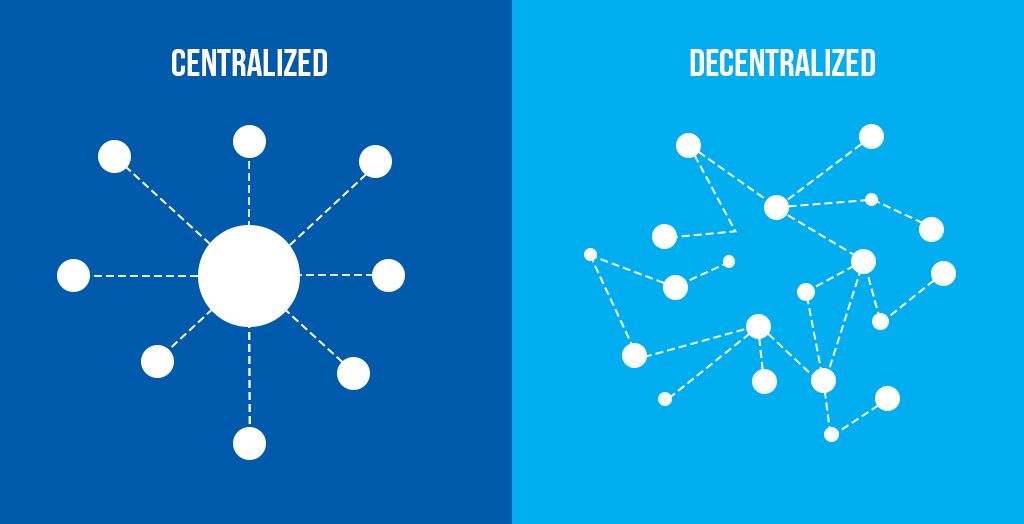

CEX stands for Centralized Exchange, while DEX stands for Decentralized Exchange. The main difference between the two is the level of centralization.

A CEX is a traditional, centralized platform that acts as an intermediary between buyers and sellers. These exchanges are owned and operated by a single entity, and they typically have more features and higher trading volumes compared to DEXs. However, they are also more vulnerable to hacking and other security issues.

On the other hand, a DEX is a decentralized platform that enables peer-to-peer trading of cryptocurrencies without the need for a central intermediary. Instead, transactions are processed and validated by a network of users. DEXs are typically more secure than CEXs, but they may have lower trading volumes and fewer features.

Decentralization: DEXs are more resistant to hacking and security threats

Privacy: No personal information or KYC/AML required

Censorship-resistant: Not controlled by any government or entity

Accessibility: Available globally with internet and compatible wallet.

Centralized or Decentralized?

Whether to use a centralized exchange (CEX) or a decentralized exchange (DEX) depends on your specific needs and preferences.

CEXs are generally better for users who prioritize liquidity and speed, as well as those who are new to crypto trading and prefer a more user-friendly interface and robust customer support.

DEXs, on the other hand, are better for users who prioritize security and privacy, and prefer to have more control over their own funds. They are also good for users who want to trade in a censorship-resistant environment.

It's also worth noting that a combination of both CEX and DEX can be used depending on the situation. For example, some users might use CEXs for larger trades to benefit from better liquidity and speed, and then move their assets to a DEX for storage and privacy.

Ultimately, it's recommended to do your own research and consider your own priorities before choosing an exchange.

Liquidity: Higher trading volumes and more trading pairs available.

Speed: Faster trade execution and deposit/withdrawal processing.

User-friendly Interface: Advanced trading interfaces and tools.

Customer support: Robust customer support teams to assist users.